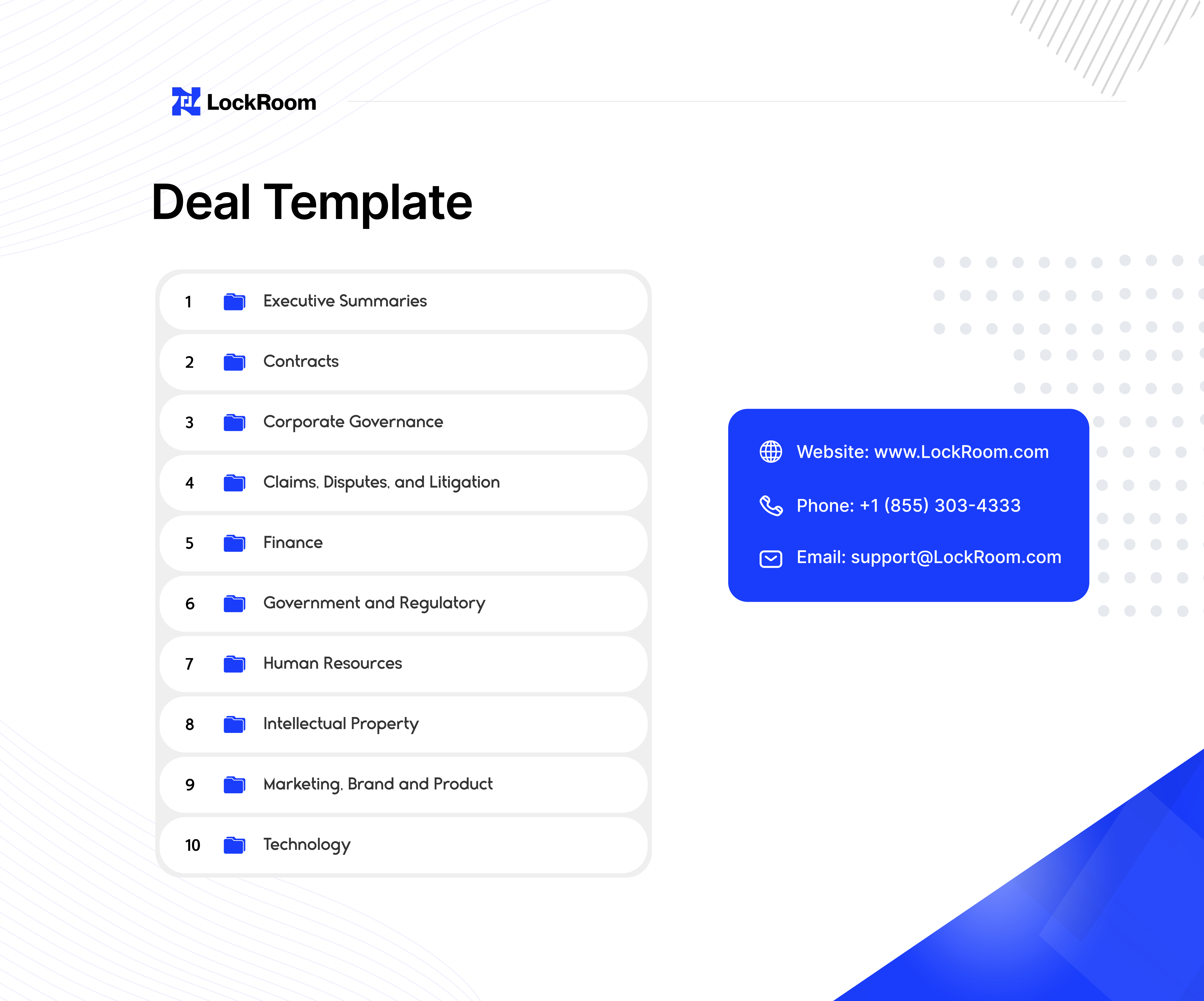

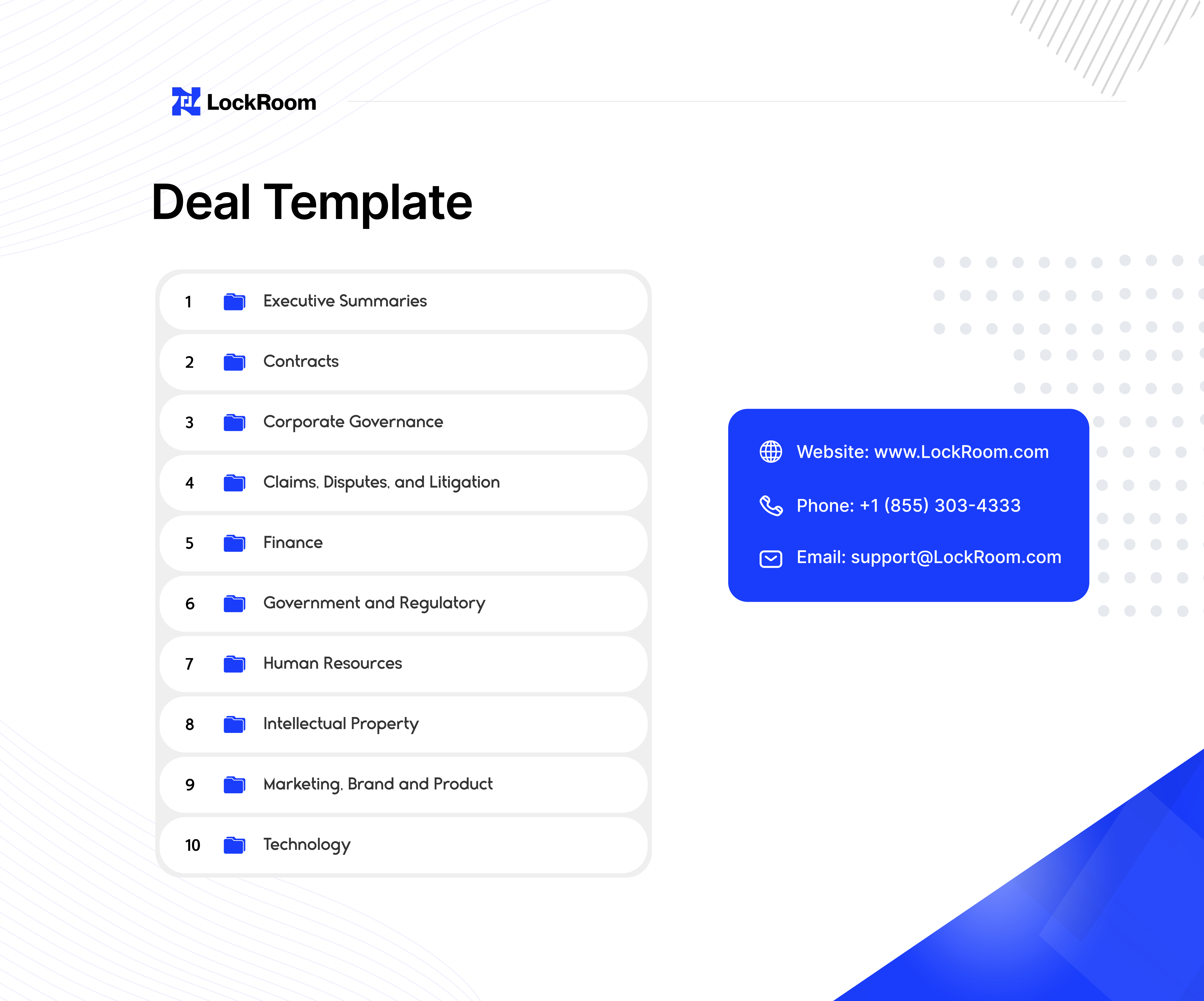

- They provide an example folder structure for deals based on your industry or deal type

- Ensure a great start to due diligence by having a virtual data room that is set up for success!

From Start to Finish: Comprehensive M&A Transaction Process Overview

Investment Banking Deal Execution: 10 Essential Steps for Successful Transactions

7 Valuation Methods in M&A: How to Determine Business Value in Acquisitions

Investment Banking Sell-Side Due Diligence: Critical Factors for Deal Closure

Mastering Deal Flow: Best Practices for Investment Banking Success

Sell-Side M&A Advisory Services

The 7 Key Stages of a Sell-Side Deal in Investment Banking

Your Roadmap To Successful M&A: An Overview Of The M&A Transaction Process

A data room is a secure place to store and share business documents for M&A deals, fundraising, and other activities that require due diligence. Data rooms are also used by law firms and journalists for regulatory reasons.

Check out this blog post on “What is a Virtual Data Room?” if you want to learn more.

- Drag & drop your existing folder structures

- Add users by entering their email

- Give or restrict access to files

That is for you to decide! This Data Room Comparison Chart allows you to compare the top data room providers.

Anywhere from $300-$1,200/month.

Check out this blog post on “How Much Should a Virtual Data Room Cost?” if you want to learn more.

Virtual Data Rooms have features that other file sharing services do not:

- Advanced Security Protocols for Compliance

- Activity Tracking

- Export Audit Logs

- Export Data Room Indexes

- Special Access Restrictions

- Watermarking for Documents

- Version Control and Reversion

Make a good impression on your investors by having a solid due diligence folder structure and virtual data room index.

Our Deal Templates show you how to set up your virtual data room for success with the proper folder structure. Every deal is different, but our templates will get you started out on the right foot.