Venture Capital

A central repository for all of your investments

VCs can set up as many data rooms as they need, at no extra cost. Manage all of your portfolio companies from one central location.

Portfolio companies enjoy the ease of keeping VC’s and other investors up to date without the heavy lifting.

Working with VC's and Investors?

Manage relationships with multiple VC's and investors

LockRoom allows you to invite multiple VCs and investors to the same data room without seeing each other. See which investors are most engaged so that you know where to focus your time.

How does LockRoom help manage investor relations?

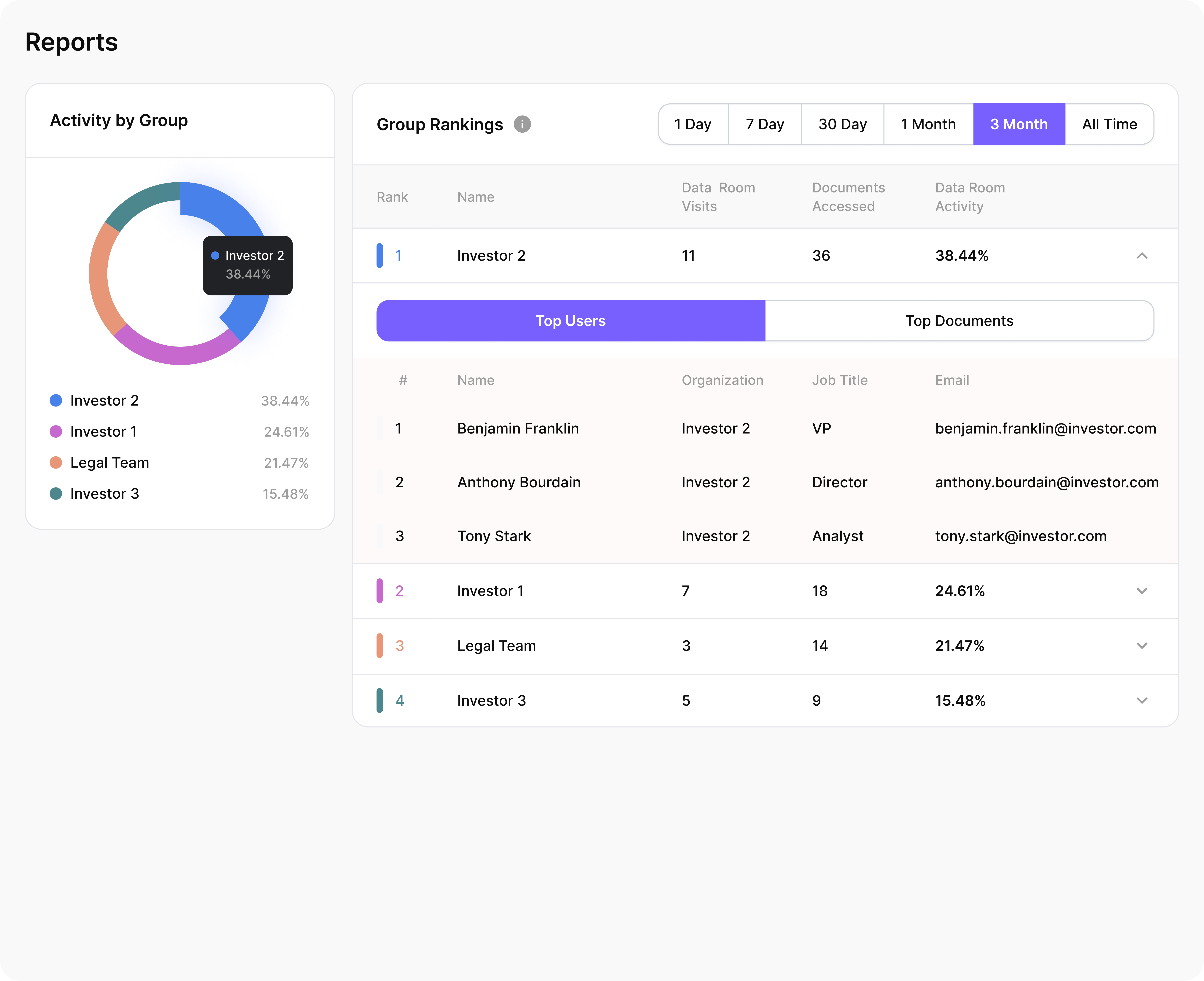

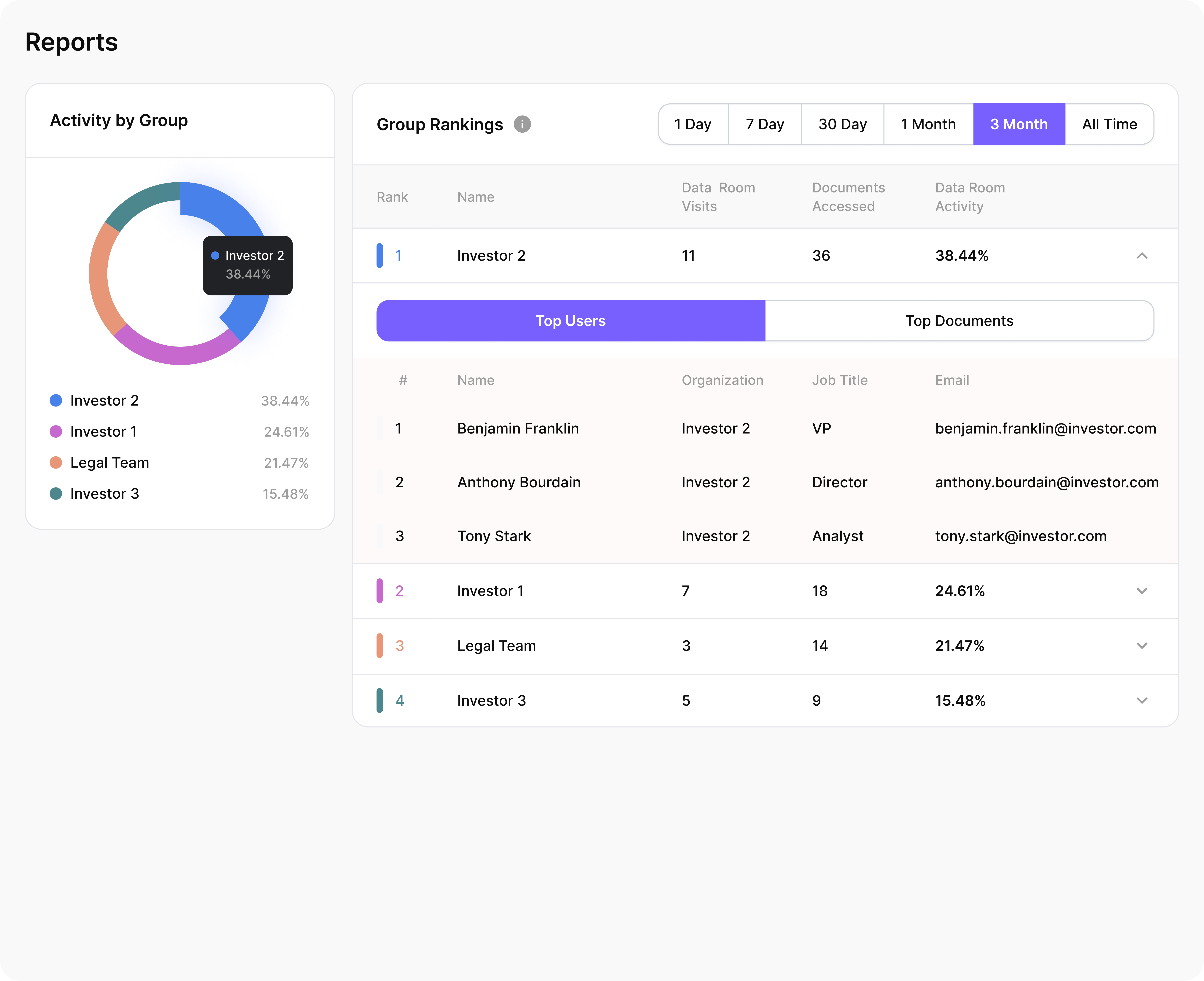

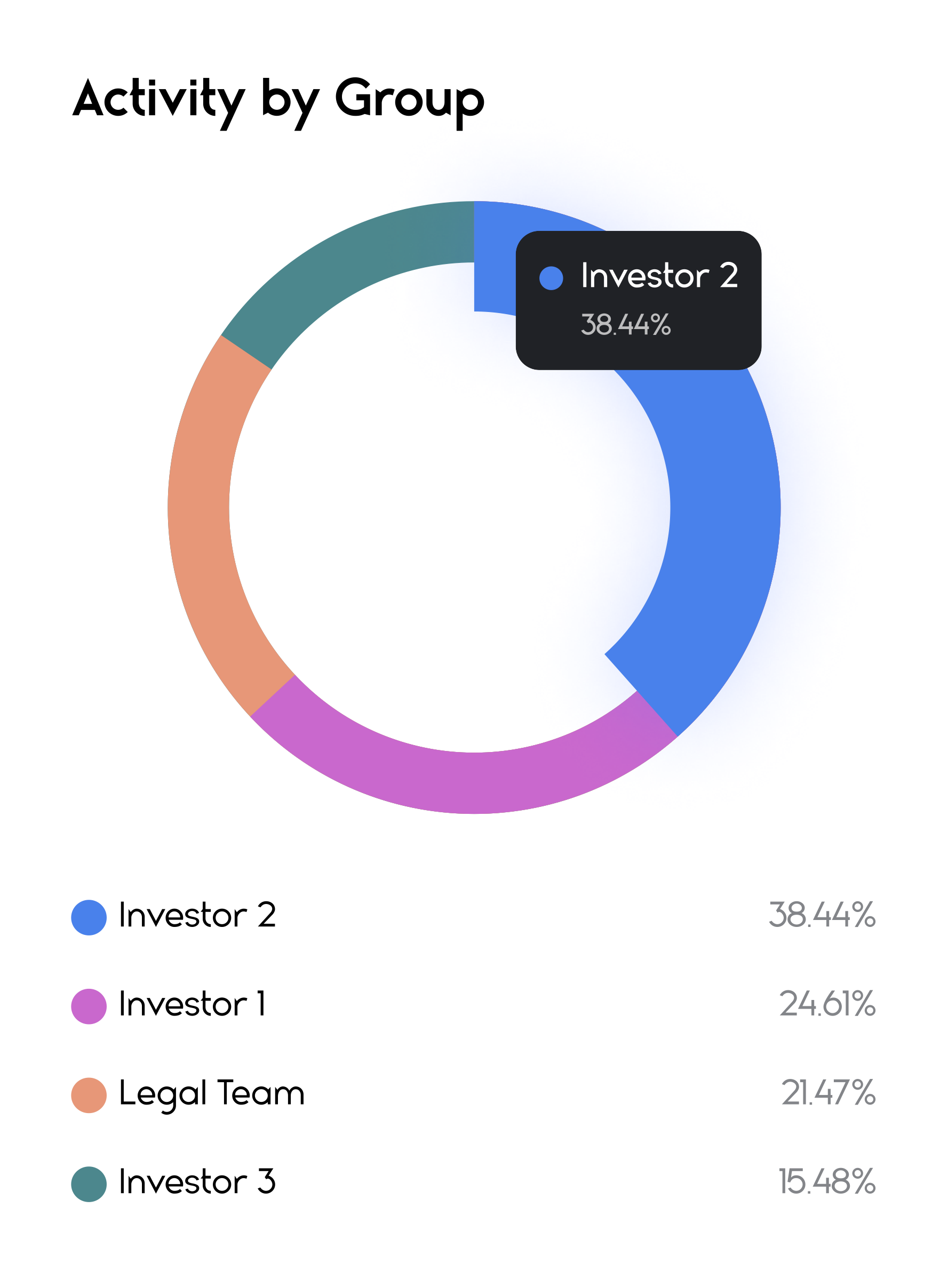

- Live reporting allows you to rank investors by their level of engagement

- Keep your internal team up to date on how conversations with investors are going

- See which documents are being engaged with the most

reduce time spent due diligence

Easily Manage Multiple Investments or Investors

Strategy & Business

Product Development

Futures Research

Understanding the Sell-Side in M&A: A Comprehensive Guide

Alphabet’s Monumental $23 Billion Acquisition of Wiz: Could It Be The Strategic Move In Cybersecurity?

Oil And Gas M&A in the US: An Outlook

Nippon Steel’s Acquisition Of U.S Steel: How It Affect Steel Production in the United States?

Navigating Healthcare Mergers: The Crucial Role of Due Diligence

Real Estate Industry M&A: 2024 Mid-year Outlook

The Role of Divestiture in Corporate Restructuring: A Case Study of General Electric (GE)

The Role of Private Equity in Driving Corporate Turnarounds

Frequently asked questions

If you have other questions, feel free to contact us.

A data room is a secure place to store and share business documents for M&A deals, fundraising, and other activities that require due diligence. Data rooms are also used by law firms, journalists, and other activities that require compliance.

1) Drag & drop your existing folder structures 2) Add users by entering their email 3) Give or restrict access to files

That is for you to decide! This Data Room Comparison Chart allows you to compare the top data room providers.

Data rooms are specifically built for M&A deals, capital raises and other investments.

Security, liability, audit logs, restrict access, track activity of users, watermarking,

Anywhere from $300-$1,200/month.